ny paid family leave tax category

A New York State tax credit that offers savings for hiring individuals with disabilities. The state of New York communicated Paid Family Leave rates and initial payroll deduction guidance on June 1 2017.

Benefits paid to employees will be taxable non-wage income that must be included in federal gross income Taxes will not automatically be withheld from benefits.

. Employers may collect the cost of Paid Family Leave through payroll deductions. Be that employees employers or insurance carriers the NYPFL category raises some questions for many. If your employer participates in New York States Paid Family Leave program you need to know the following.

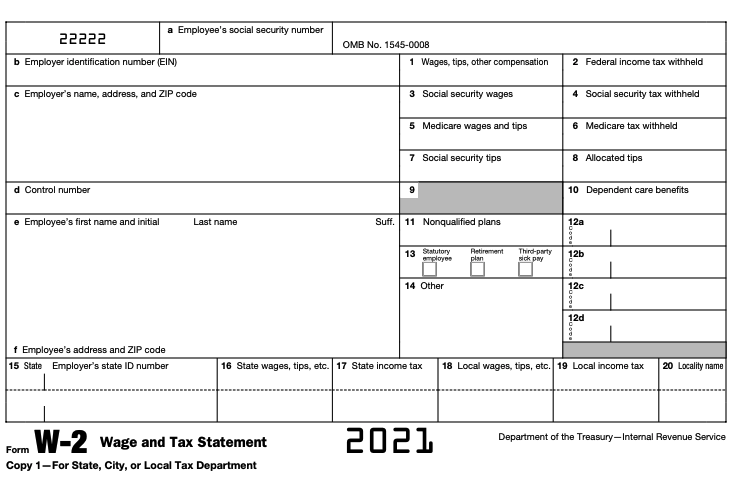

What category description should I choose for this box 14 entry. It was recently made part of the W-2 form in 2018 and the employer is required to fill it just as other boxes on the form. Healthy Delaware Families Act I-9 Independent Contractors IRS Labor Shortages Maximum Weekly Benefit Amount New Jersey New York Paid Family Leave Payroll Tax Pennsylvania unemployment compensation RD RD tax credit for startups Reemployment Tax reference checks research and development SB.

You will receive either Form 1099-G or Form 1099-MISC. If an employer chooses to hire a temporary employee to replace a regular employee while they are on Paid Family Leave could the temporary employee file for. State disability needs to be reported separately from the Paid Family Leave in box 14 of Form W-2.

Fully Funded by Employees. Set up the NY. Get answers to your questions or other assistance on Paid Family Leave by calling the toll-free Helpline at 844 337-6303.

You may request voluntary tax withholding. For the last couple of years NYS have being deducting premiums for the Paid Family Leave program. NYPFL in Box 14 of your W-2 should be listed under the category of Other deductible state or local tax when you are entering your W-2 on the federal screen.

On this years New York State W-2 in Box 14 there is NYPFL which is for New York Paid Family Leave. Set the appropriate NY rates for Family Leave Rate and Family Leave Wage Base. Paid Family Leave Benefits available to employees as of.

Employees can request voluntary tax withholding. Paid Family Leave provides eligible employees job-protected paid time off to. NYPFL or New York Paid Family Leave has caused some confusion regarding tax for New Yorkers.

Bond with a newly born adopted or fostered child Care for a family member with a serious health condition or. Persons engaged in a professional or teaching capacity for a not. August 29 2017.

Paid Family Leave benefits are not subject to employee or employer FICA FUTA or SUTA. Based upon this review and consultation we offer the following guidance. Your PFL benefits are taxable.

The maximum annual contribution for. The paid family leave can be called Family Leave SDI as long as it is a separate item in box 14. On this years New York State W-2 in Box 14 there is NYPFL which is for New York Paid Family Leave.

They are however reportable as income for IRS and NYS tax purposes. New York Paid Family Leave is insurance that is funded by employees through payroll deductions. This amount is be deducted from employees post-tax income and is appear on their paystubs as a post-tax deduction.

Tax treatment of family leave contributions and benefits under the New York program. Assist loved ones when a spouse domestic partner child or parent is deployed abroad on active military service. This deduction shows in Box 14 of the W2.

The maximum employee contribution in 2021 is 0511 of an employees weekly wage with a maximum annual contribution of 38534. The description have not being added on the drop down menu of the W2 worksheet forcing to list it as Other. After discussions with the Internal Revenue Service and its review of other legal sources the New York Department of Taxation and Finance issued guidance regarding the tax implications of its new paid family leave program.

Fully Funded by Employees. On this years New York State W-2 in Box 14 there is NYPFL which is for New York Paid Family Leave. New York paid family leave benefits are taxable contributions must be made on after-tax basis.

However under the Paid Family Leave law some categories of workers are excluded from the definition of employee and employment. Yes NY PFL benefits are considered taxable non-wage income subject to federal income tax. New York State Paid Family Leave is insurance that may be funded by employees through payroll deductions.

In 2022 the employee contribution is 0511 of an employees gross wages each pay period. State disability needs to be reported separately from the Paid Family Leave in box 14 of Form W-2. On the 2020 edition there is no Other option please see the screenshot above.

The original Turbo Tax answer about a year ago to this question was incorrect which is why I responded as I did with the correct info and the NYS link stating that NYPFL is a state disability insurance tax. Youll find answers to your top taxation questions below. Confirm the clients state is NY.

Most employees who work in New York State for private employers are eligible to take Paid Family Leave. Any benefits you receive under this program are taxable and included in your federal gross income. Paid Family Leave benefits received by an employee are not considered remuneration for UI reporting purposes and are not subject to contributions.

Now after further review the New York Department of Taxation and Finance has provided important guidance regarding payroll deduction and PFL taxation. Paid Family Leave may also be available in some situations when an employee. Examples include licensed ministers priests or rabbis.

Your employer will not automatically withhold taxes from these benefits. Paid Family Leave Helpline. Each year the Department of Financial Services sets the employee contribution rate to match the cost of coverage.

Employee-paid premiums should be deducted. What category description should I choose for this box 14 entry. The New York State Department of Taxation and Finance DOTF issued much-needed guidance regarding the tax treatment of deductions from employee wages used to finance paid family leave premiums and the tax treatment of paid family leave benefits to be received by eligible employees.

What category description should I choose for this box 14 entry. The description for this entry is PAID FAMILY LEAVE. The contribution remains at just over half of one percent of an employees gross wages each pay period.

The maximum annual contribution is 42371. Healthy Delaware Families Act I-9 Independent Contractors IRS Labor Shortages Maximum Weekly Benefit Amount New Jersey New York Paid Family Leave Payroll Tax Pennsylvania unemployment compensation RD RD tax credit for startups Reemployment Tax reference checks research and development SB.

The Middle Class Crunch A Look At 4 Family Budgets The New York Times

On This Year S New York State W 2 In Box 14 There Is Nypfl And Nydbl What Category Description Should I Choose For These Box 14 Entries

Cost And Deductions Paid Family Leave

New York S Balance Of Payments In The Federal Budget Federal Fiscal Year 2020 Office Of The New York State Comptroller

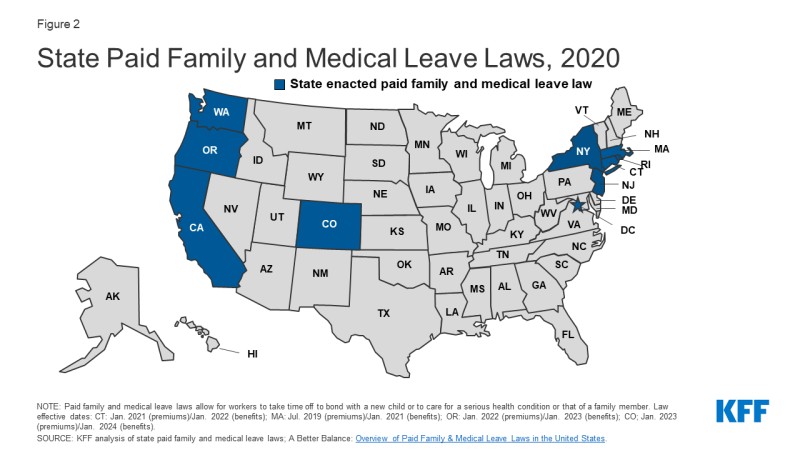

New National Paid Leave Proposals Explained

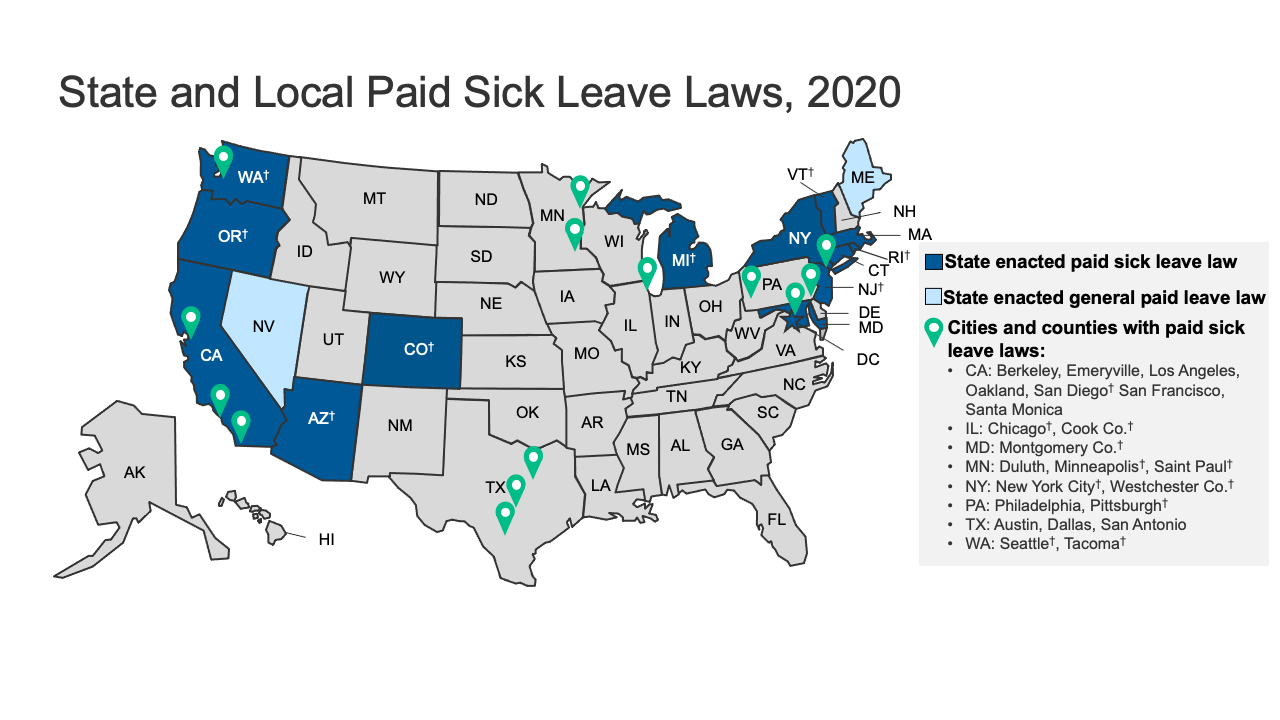

Time Off To Care State Actions On Paid Family Leave

Time Off To Care State Actions On Paid Family Leave

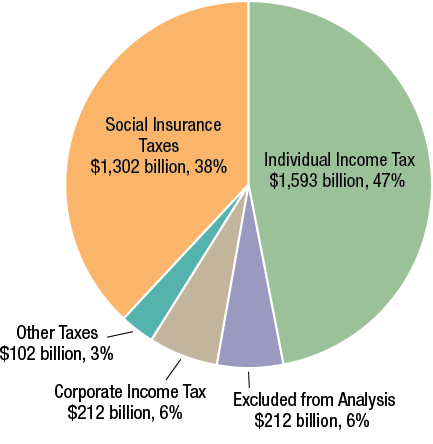

Types Of Taxes Income Property Goods Services Federal State

What Are Itemized Deductions And Who Claims Them Tax Policy Center

How To Read Your W 2 Justworks Help Center

Division Of Temporary Disability And Family Leave Insurance Information For Employers

2021 Instructions For Schedule H 2021 Internal Revenue Service

Coronavirus Puts A Spotlight On Paid Leave Policies Kff

Coronavirus Puts A Spotlight On Paid Leave Policies Kff

Implications Of Allowing U S Employers To Opt Out Of A Payroll Tax Financed Paid Leave Program Equitable Growth

New York S Balance Of Payments In The Federal Budget Federal Fiscal Year 2020 Office Of The New York State Comptroller